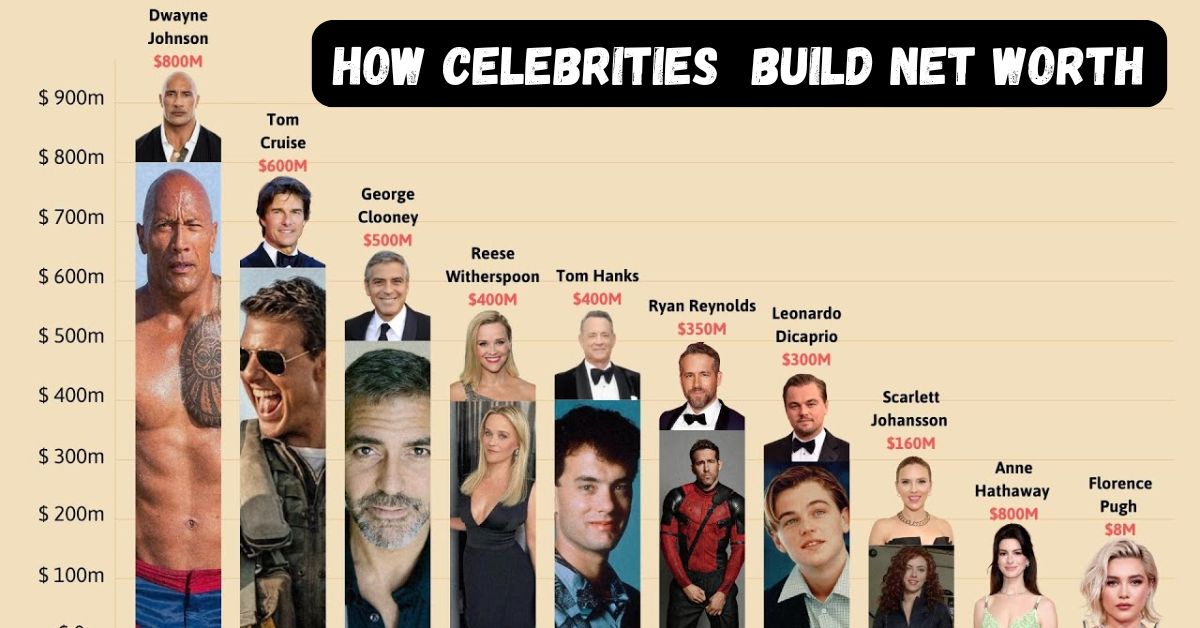

how celebrities and entrepreneurs build net worth for celebrities and entrepreneurs is not a stroke of luck—it’s a result of vision, planning, and financial discipline. From Michael Jordan’s $3 billion Charlotte Hornets (NBA) deal to Shawn Carter (Jay-Z) becoming a hip-hop billionaire, and Kim Kardashian’s rise through her Skims brand value and 35% stake, every move reflects mastery in business understanding and financial management. Their journeys reveal how assets minus liabilities, equity, and ownership drive financial success and long-term wealth creation.

Strategies How Celebrities & Entrepreneurs Build Net Worth

- Diversified Business Ventures: Investing in sports, tech, beauty, liquor, and real estate to increase revenue and profits.

- Strategic Investing Decisions: Focusing on market value, capital, and valuation to expand their portfolio and financial position.

- Brand Endorsements & Assets: Using luxury cars, estates, and brand value to elevate monetary worth and overall financial standing.

- Sustainability Over Hype: Prioritizing long-term success, financial growth, and sustainability instead of chasing short-lived fortune.

- Financial Prowess & Ownership: Applying deep business understanding and maintaining control through strong equity and ownership stakes.

Their approach proves that building lasting wealth isn’t about popularity or sudden fame—it’s about consistent finance success, sustainable entrepreneurial ventures, and a clear understanding of one’s economic value as an investor.

Determining Your Net Worth: A Practical Example

As financial expert Rachel Keatinge explains, building net worth depends on knowing your assets, liabilities, and overall financial health. By doing a proper calculation of financial assets like a house, mutual funds, or savings account, and comparing them with total liabilities such as a home loan, car loan, or debt, you can uncover your true monetary value and wealth. The market, real estate, and stocks constantly change with financial conditions, making net worth a dynamic number that reflects your spending, saving, and investment habits. This analysis helps maintain balance, strengthen equity, and improve your financial stability, property growth, and market value through disciplined capital and asset management.

Read more about influential business personalities and their wealth insights in our detailed guide: Celebrity Net Worth Guide

Fundamentals of Understanding Net Worth

- Identify Assets and Liabilities: List all financial assets and total liabilities for accurate valuation and analysis.

- Monitor Market Changes: Track stocks, real estate, and financial conditions affecting market value.

- Focus on Financial Health: Maintain balance, manage debt, and build equity for stable wealth growth.

- Develop Smart Investment Habits: Regular saving, spending control, and consistent investment improve financial stability.

- Use Asset Management Wisely: Optimize capital, enhance monetary value, and strengthen long-term property and market performance.

How to Grow Your Net Worth

When it comes to net worth, every successful entrepreneur and celebrity understands the importance of strategic financial planning and disciplined money management. From my own experience advising clients, I’ve seen how taking practical ways to reduce debt and meet financial obligations sets the foundation for growth. The avalanche approach, for instance, focuses on clearing high-interest debt first, freeing more income to channel toward savings and investments. This kind of smart financial strategy helps create balance between assets and liabilities, strengthening long-term financial goals .Jet-set across the world with celebrity-style luxury travel.

Increase Your Income Streams

Increasing your income is another proven step toward financial independence. Many build their wealth by pursuing a raise, taking up a freelance project, or starting a side business that complements their main work. Others prefer generating passive income through dividend-paying stocks or rental properties, which steadily contribute to financial accounts and secure stability for the future. Every successful investor I’ve met believes in making progress through consistent action and disciplined financial habits that lead to greater control and freedom.

Invest Strategically for Long-Term Growth

To sustain long-term growth, it’s crucial to track your financial clarity and regularly monitor your assets, liabilities, and trends. Tools like digital tools or spreadsheets can help evaluate and manage tax-advantaged savings, mutual funds, fixed deposits, and retirement plans effectively. When you align your financial accounts with your financial goals, the result is not just more wealth, but also true stability and confidence in your financial journey.

FAQS

1. How many people in America are considered high-net-worth?

Around 7.5 million Americans fall into the high-net-worth category, meaning they have over $1 million in investable assets (excluding their homes).

2. How much should I have saved?

A good rule of thumb — save at least 15–20% of your income and aim for your annual salary saved by age 30, doubling it every decade after.

3. How do I calculate my net worth?

Simply add up everything you own (cash, property, investments) and subtract everything you owe (debts, loans, credit). The result is your net worth.

4. What is a good net worth?

A “good” net worth depends on your age and goals — but having at least 6x your annual income by retirement is a solid benchmark.